Negotiate a car loan rate and a lower dealer interest rate.

You’ve found the car you want in the bustling Las Vegas car market, but your stomach drops when you think about credit—especially if you're planning a road trip or driving through the desert. Here’s the quick answer to what credit score for dealer financing: there isn’t a strict universal minimum, but scores around 600 can often get a basic approval. Higher scores usually get lower rates, better terms, and more choice, which is crucial for reliable auto financing on routes like LA to Las Vegas.

Credit scores matter because they signal risk to the lender. A higher score often means a lower APR and fewer fees, which can save thousands over the life of the loan. If your score sits under 600, approval is still possible, but expect tighter terms and a higher payment. This is where smart prep makes a real difference, particularly in a major hub like Las Vegas where vehicle options abound.

For most buyers, a minimum credit score car loan target near 600 works as a starting point. If you’re at 661 or higher, you’re moving into better rate territory, especially on new cars—perfect for spotting the iconic Welcome to Fabulous Las Vegas Sign on your next journey. At 700 and up, you can qualify for stronger offers and shorter terms at fair costs.

This guide breaks down exactly what to expect and how to improve your odds. First, you’ll see a clear credit score ranges and rates table, covering Excellent (750+), Good (700 to 749), Fair (650 to 699), and Poor (below 650). Then we explain how dealers evaluate credit, including income, debt, down payment, and vehicle choice.

Next, you’ll get practical steps to boost approval chances fast, from lowering credit card balances to choosing the right loan length. We’ll cover subprime lender options for bad credit dealer financing, what to watch for, and how to avoid expensive traps. You’ll also learn how a co‑signer strategy can cut your rate and widen your choices.

By the end, you’ll know where you stand, what to ask for, and how to secure a deal that fits your budget. Let’s get you the keys without overpaying.

Credit Score Basics for Auto Loans

Getting dealer financing starts with the score a lender sees on your file. That number guides the APR, term length, and even which lenders will look at your deal. When you ask what credit score for dealer financing, the scoring model behind the number matters as much as the number itself—especially for buyers in the Las Vegas market navigating local dealership options.

Image created with AI

Image created with AI

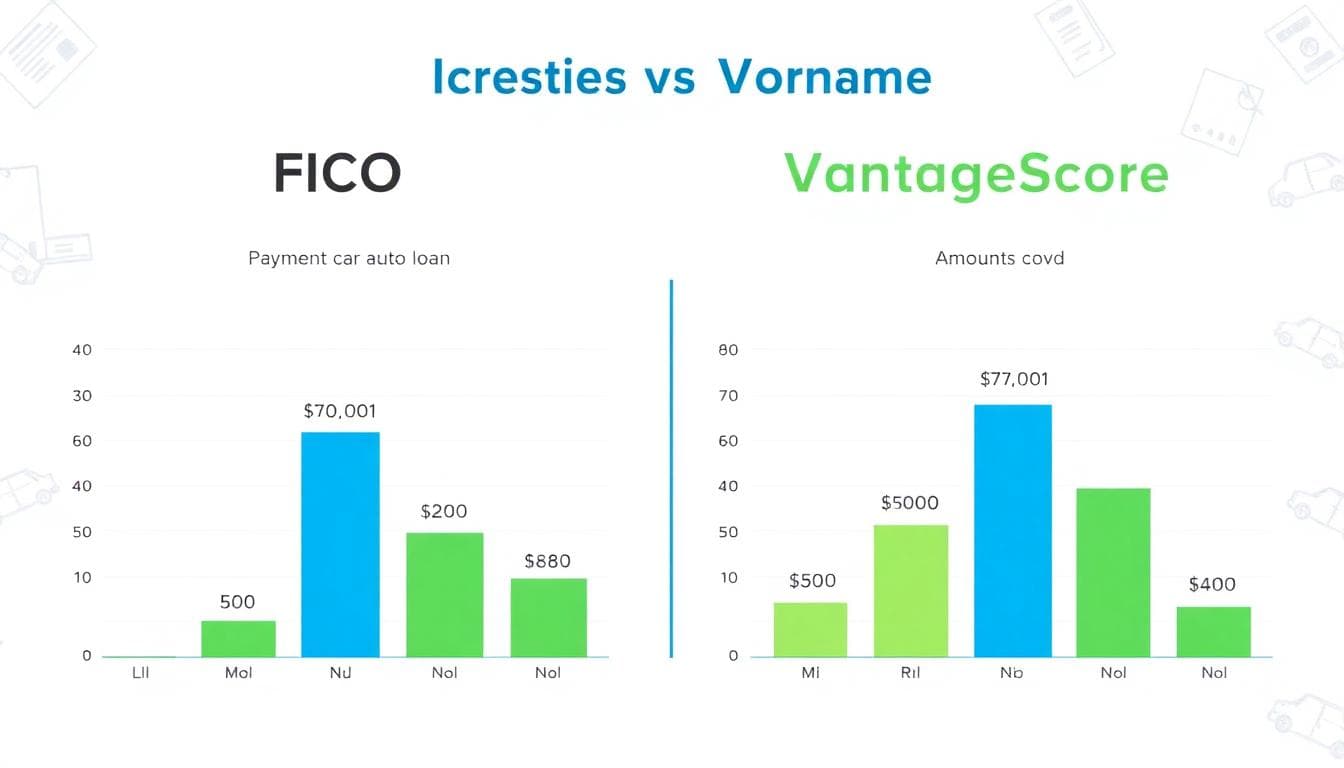

FICO vs. VantageScore: Which One Dealers Use

Most dealers and auto lenders use a FICO version for credit decisions, often an industry model called FICO Auto Score. VantageScore appears on many consumer apps, and some lenders use it, but it is less common for auto approvals. This split explains why your app score can look different from the number a finance manager quotes, particularly when considering local factors like those around landmarks such as Seven Magic Mountains.

Use these quick points to compare what lenders may see:

Score range: Both use 300 to 850 today. Your number may still vary between models because of different math and data treatment. See how the models differ in approach in Experian’s overview of how FICO and VantageScore differ.

Inquiry “shopping window”: FICO counts rate shopping for auto loans within a 45‑day window as one inquiry for scoring, while VantageScore’s window is 14 days. Equifax explains these shopping windows in its guide to the difference between FICO and VantageScore. Plan your applications with that timing in mind.

Model versions: Lenders can use different versions. FICO 8, 9, or 10 are common base models, and FICO Auto Score versions sit on top of that. VantageScore 3.0 and 4.0 are the most used versions on consumer apps and some lenders.

Weighting: Both models reward on-time payments and lower balances. Differences in how they weigh recent late payments, utilization, or thin files can shift your score by dozens of points. Lenders may also factor in local risks, such as Las Vegas driving conditions that heighten collateral concerns due to urban traffic and desert heat.

Here is a quick snapshot that shows how this affects dealer decisions:

ItemFICO (often FICO Auto Score)VantageScoreScore range300 to 850300 to 850Common use in autoPrimary model for many lendersSecondary, used by some lenders and appsRate shopping window45 days treated as one inquiry14 days treated as one inquiryImpact on approval termsSets APR tiers at many dealershipsCan differ from dealer’s pull, causing confusion

Why this matters for you: the model can shift you across a pricing tier. If your VantageScore shows 660 but the dealer’s FICO Auto Score reads 635, you might fall from a mid tier to a subprime tier. That can raise your APR and reduce lender choices for bad credit dealer financing.

Practical moves before you shop:

Check both: Look at your FICO and VantageScore so you are not surprised at the store.

Time your applications: Keep your auto credit pulls within one shopping window to limit inquiry impact.

Target thresholds: For a minimum credit score car loan, aim near 600 as a baseline, then try to push above 660. That helps you qualify for better FICO tiers that many dealers use.

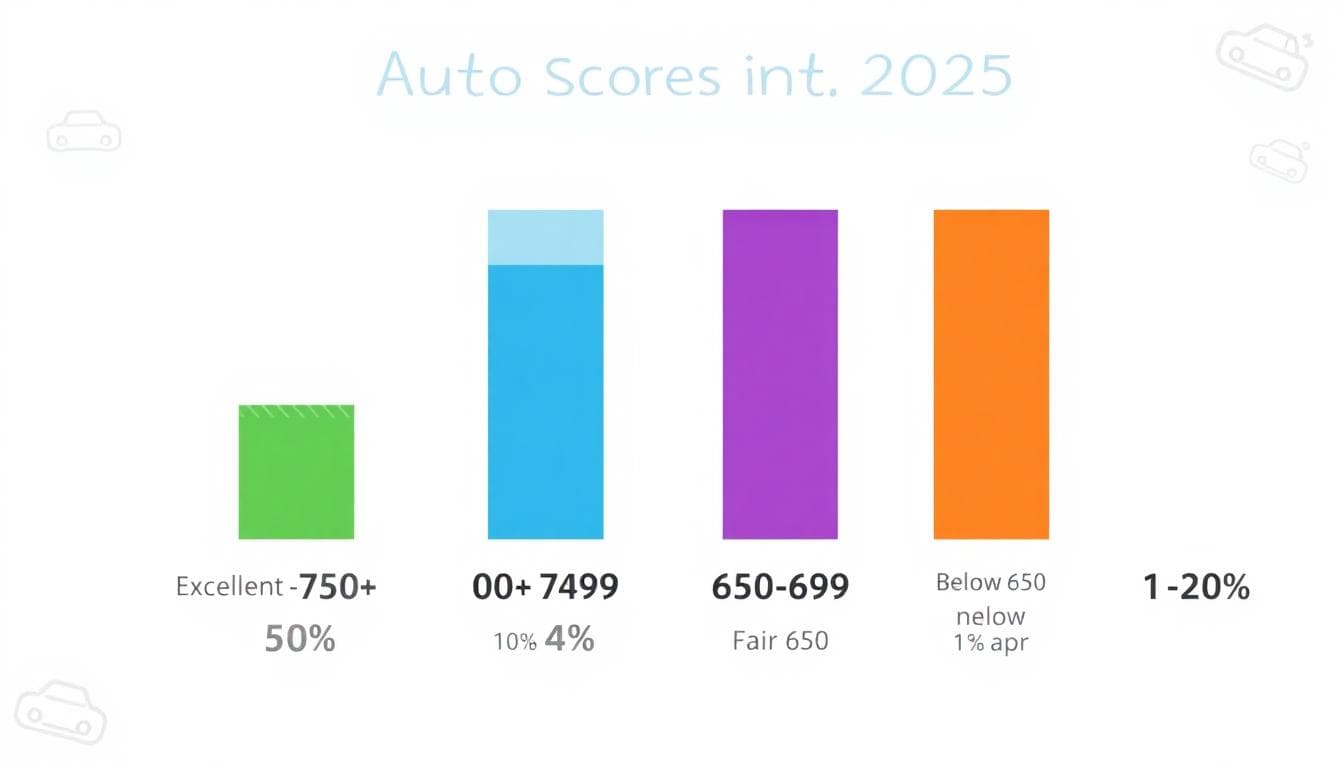

Credit Score Ranges and Interest Rates for Dealer Financing

Understanding how scores map to rates helps you plan your budget and pick the right lender. The ranges below give a practical view of what you might see in 2025. If you are asking what credit score for dealer financing gets you the best deal, higher tiers almost always win on rate, fees, and choice of lenders—especially when comparing competitive dealer financing quotes in vibrant markets like Las Vegas.

Image created with AI

Image created with AI

Here is a quick snapshot for context. Rates vary by lender, term, and vehicle, but this table reflects current averages and lender tiering in 2025.

Credit tierScore rangeTypical APR, newTypical APR, usedWhat it means at the dealershipExcellent750+5% to 7%6% to 8%Best approval odds, top-tier promos, flexible termsGood700 to 7497% to 9%9% to 12%Strong approvals, competitive offers, more lendersFair650 to 69910% to 13%12% to 16%Approval likely, higher rate, tighter termsPoorBelow 65014% to 20%+17% to 24%+Limited lenders, bigger down payment often required

For fresh market context, see Experian’s breakdown of average auto APRs by score in 2025, which shows a clear step-up from excellent to subprime tiers: Experian average car loan rates by credit score. NerdWallet also tracks recent averages by credit band and loan type: Average car loan interest rates by credit score.

What Excellent and Good Scores Unlock

Top-tier credit turns dealer financing into a simple process. If you sit at 750 or higher, you usually qualify for the lowest dealer APRs on new cars, often in the 5 to 7 percent range for common terms. Approval is fast, documentation is light, and lenders compete for your deal. Many credit unions and captive lenders publish top-tier rates that align with this range. As a reference point for strong-credit borrowers, Navy Federal’s published ranges give a sense of how low top-credit rates can go on shorter terms in 2025: Auto Loan Rates for New & Used Cars.

What you can expect with excellent or good credit:

Lower total cost: A 1 to 2 point APR drop can save thousands over 60 to 72 months, preserving value for long-term adventures like trips to a nearby National Park.

Shorter terms at fair payments: The rate advantage helps you avoid stretching to 84 months.

Broader lender pool: Banks, credit unions, and captive lenders all say yes, so you can pick the best offer.

Promotional offers: Some brands run limited-rate programs for qualified buyers on select models.

Real-world example:

A buyer at 740 gets preapproved at 7.2 percent for 60 months from a credit union. The dealer’s captive offers 6.9 percent on the same term with a modest rate discount for autopay. With excellent income and a clean file, the buyer chooses the captive offer and closes the same day—perfect for planning a scenic drive through stunning landscapes.

If you are in the 700 to 749 band, you still get strong offers, usually 7 to 9 percent on new cars. Many lenders view this as near prime. You might see a slightly higher rate than the top tier, but approval and choice remain solid, allowing you to secure competitive rates in areas like Las Vegas where dealer financing quotes can vary widely.

Tip for top tiers:

Bring a preapproval to keep dealer quotes honest. Compare against averages from sources like US News Cars’ current averages and do not accept add-on products that erase the rate advantage.

Navigating Fair Credit: Still Viable Options

Scores from 650 to 699 still clear most dealer approvals. You will likely pay a higher rate, often around 10 to 13 percent for new cars. Lenders in this band want to see more strength in the file, such as a steady job, proof of residence, and a down payment. You still have options, but pricing and loan structure matter more, especially for vehicles that hold up during everyday travel scenarios.

Ways to strengthen your application before you apply:

Drop card balances: Push credit utilization under 30 percent. Even a small paydown can lift your score a tier.

Show paycheck stability: Two or more recent pay stubs and 30 to 90 days on the job looks better.

Add a down payment: 10 percent can improve approval odds and lower the payment.

Choose the right car: New or late-model used cars price better than older, high-mileage units at this tier.

Limit inquiries: Keep your rate shopping within a short window to avoid score drag.

Pricing example:

A buyer at 665 wants a $28,000 compact SUV. With 10 percent down and a 60-month term, approval comes back at 11.9 percent from a bank partner and 11.2 percent from a credit union partner. The credit union wins with a small auto-pay discount and no origination fee.

Positioning tip:

Ask the finance manager for a tier bump review. If you have strong income, a clean housing history, and a stable job, some lenders permit an exception to move you from a mid tier to the top of the band, which can shave rate.

Challenges with Poor Credit Scores

Scores below 650 start to limit lender choices. Under 600, you are in bad credit dealer financing territory. Approval is still possible, but the rate jumps, and lenders may require a larger down payment. Expect more proof of income and a tighter call on the vehicle you choose, particularly one that can withstand harsh environments like Death Valley.

What to plan for if your score is under 650:

Higher APRs: New car rates often run 14 percent and up, used can run even higher.

Bigger down payment: Plan for 10 to 20 percent down. More equity reduces lender risk.

Shorter terms or capped amounts: Lenders may limit the amount financed or offer shorter terms to control risk.

Vehicle caps: New or certified pre-owned models are favored, ensuring reliability for visits to local attractions like Hoover Dam. Very old or high-mileage cars can be harder to finance at this tier.

Approval example:

A buyer at 585 puts 15 percent down on a $22,000 sedan and provides full income documentation. The dealer’s subprime partner approves at 18.5 percent for 60 months, with a modest acquisition fee and a hard cap on add-ons—vital for dependable trips to destinations like the Grand Canyon in Arizona.

Smart moves to improve your odds fast:

Bring a co-signer with strong credit: This can shift you from subprime to near prime and cut your APR.

Pay down one card: A small utilization drop can push you above 600, which may open more lenders.

Target a lower price: A modest vehicle and realistic payment reduce lender risk, supporting reliable financing necessary for longer trips to these destinations.

If you are still deciding what credit score for dealer financing you should aim for, push to break 600 as a minimum credit score car loan threshold. Then, work toward 660 to unlock better terms and more lenders. For current averages and market direction, it helps to check a broad source that updates often, like Bankrate’s 2025 auto loan rates overview.

How Dealers Check and Evaluate Your Credit

Before a dealer talks rates, they run your credit and size up the whole deal. They look at your score, your income, your debts, and the car you want. Understanding this process helps you protect your rate, avoid surprises, and support your case for approval. If you are asking what credit score for dealer financing matters most, the answer is the score the lender sees at the time they pull it, paired with a strong overall profile—especially when applying at a Las Vegas dealership where local market factors can influence the evaluation.

Image created with AI

Image created with AI

How the Credit Pull Works

Dealers submit your application to one or more lenders. This can result in several hard inquiries within a short window, a practice often called shotgunning. Credit scoring models usually treat auto inquiries within a set window as a single event for scoring, which helps reduce impact. For a quick primer on what happens when the dealer shops your application, see Kelley Blue Book’s guide on dealership credit checks and inquiry shopping.

What to do:

Apply within a short window to keep inquiry impact low.

Bring a preapproval to compare offers and stress less about timing—particularly if you're from Las Vegas and want to align with regional lender preferences.

What Lenders Review Beyond Your Score

A score opens the door, but the full file wins the terms. Dealers and lenders review core risk signals built around the Five Cs of credit.

Credit history: On-time payments, length of history, recent late payments.

Capacity to pay: Income, debt load, and payment fit.

Capital: Down payment and equity in the deal.

Collateral: The car itself, age, miles, and loan-to-value, including assessments of driving risks in rugged local terrain like Red Rock Canyon.

Conditions: Term length, rate environment, and lender policies.

For a quick refresher on what lenders prioritize, this overview of [three key things lenders look at for auto

Bad Credit Dealer Financing: Your Options and Strategies

Shopping with a score under 600 can feel like walking uphill. You still have a path to approval, and you can avoid costly mistakes if you know where dealers send these loans and how to structure the deal. Keep the focus on realistic payments, a car that holds value, and small moves that raise your odds fast. If you wonder what credit score for dealer financing gets a yes in this tier, approvals often start in the low 500s with the right lender, but the terms change a lot based on your profile—especially in areas like Las Vegas, where specialized subprime lenders cater to local drivers planning longer journeys.

Image created with AI

Image created with AI

Working with Subprime Lenders for Approval

Scores from 501 to 600 sit in subprime territory. Dealers work with specialized lenders that price for higher risk and often need more proof of income and a larger down payment. Your goal is simple: reduce risk in the eyes of the lender, particularly when subprime loan requirements tie into the type of travel the car is intended for, like reliable performance on extended drives from Las Vegas to remote spots.

What subprime lenders look for:

Steady income: Two or more recent pay stubs, W‑2s if asked, and verifiable employment.

Reasonable payment-to-income: Keep the projected car payment under 10 to 15 percent of gross monthly income.

Equity in the deal: A down payment of 10 to 20 percent shows commitment and lowers loan-to-value.

Right car choice: Late-model, warranty-backed cars price better than older, high-mileage units, ensuring the vehicle is robust enough for distant travel to places like Zion National Park in Utah or remote destinations such as Antelope Canyon and Horseshoe Bend, which are accessible only with a functioning vehicle suited for a road trip.

Smart ways to set up the deal:

Pick a modest vehicle: A smaller loan amount improves approval odds and payment fit.

Shorten the term slightly: Avoid 84 months if you can, aim for 60 to 72 months to manage rate and total interest.

Bring documents: License, proof of insurance, pay stubs, and a current utility bill for residence.

Know the landscape before you sign. Experian explains how subprime auto loans work, including why rates run higher and how lenders assess risk. See the guide on subprime auto loans and rates. For a snapshot of current options targeted at poor credit, Bankrate’s list of best bad credit auto loan rates helps you benchmark offers. As a quick reference, some dealers sort tiers like this: 501 to 600 as subprime, 300 to 500 as deep subprime, and 601 to 660 as near prime, which aligns with many stores’ internal charts like this example of subprime tier definitions.

Quick example:

You have a 565 score and $4,000 to put down on a $19,000 sedan. A subprime partner approves at a higher APR because of the score, but the strong down payment, steady job history, and a reliable car choice clear the path to a yes.

Using a Co-Signer to Boost Your Chances

A co-signer with strong credit can transform your deal. The co-signer shares legal responsibility, which lowers the lender’s risk and can move your file from subprime to near prime. That often means a lower APR, a larger loan amount, and more lender choices.

Why a good co-signer helps:

Lower APR: The lender prices the loan to the stronger profile, which can cut the rate by several points.

Higher approval odds: Thin files, past late payments, or short job history carry less weight with a qualified co-signer.

Better terms: You may get a shorter term at a fair payment, or avoid fees tied to higher risk.

Pros:

Rate relief: Lower interest reduces total cost over the full term.

Access to better cars: You might qualify for newer models with stronger resale value.

Faster approval: Clean credit and stable income on the co-signer’s side speed up underwriting.

Cons:

Shared liability: Missed payments hit both credit reports and can strain the relationship.

Hard to remove: Many lenders do not offer co-signer release, and removal often requires a refinance.

Behavior risk: Late payments by you can damage the co-signer’s credit standing.

Ground rules to protect both parties:

Put payment alerts and autopay in place on day one.

Keep the loan in your budget even without the co-signer’s help.

Revisit refinancing after 12 to 24 months of on-time payments to remove the co-signer if your score rises.

For a balanced view of tradeoffs, see Experian’s breakdown of the pros and cons of a cosigner on a car loan. LendingTree also outlines cosigned auto loan pros and cons, including when it makes sense for bad credit dealer financing.

Key takeaway: If you are under 600 and asking what credit score for dealer financing will get better terms, a qualified co-signer can be the difference between an 18 percent offer and something closer to near-prime pricing. Pair that with a solid down payment and a realistic car choice to lock in a deal that fits.

Steps to Improve Your Credit Score for Better Car Deals

Raising your score before you shop can lower your APR, widen lender options, and help you qualify for stronger terms. Even small gains can move you into a better pricing tier, which directly improves what credit score for dealer financing unlocks at the showroom. Think of this as tuning your file so lenders see less risk and more consistency—like mapping out a classic travel route where every checkpoint builds toward smoother sailing.

### Quick Wins to Raise Your Score Fast

### Quick Wins to Raise Your Score Fast

Target actions that register quickly with scoring models, much like planning an itinerary for your credit repair journey along the iconic Route 66. The goal is to cut risk signals and highlight steady behavior before you apply, making strategic stops to build momentum efficiently.

Pay credit cards to under 30 percent utilization: Higher balances hurt scores. If you can, push key cards under 10 percent for an extra boost.

Make an immediate on-time payment streak: Autopay prevents slipups. A month or two of clean on-time activity helps stabilize recent history. See practical guidance in Experian’s list of 25 tips to improve credit in 2025.

Dispute report errors: Incorrect late payments or balances can drag scores. Pull reports from all three bureaus and fix any errors fast.

Ask for a credit limit increase without a hard pull: A higher limit lowers utilization. Keep spending the same to get the benefit.

Pay down one card at a time: Reducing a single high-utilization card can move the needle more than tiny payments across several cards.

Become an authorized user: A trusted family member’s well-managed, older card can add history and lower utilization on your profile. NerdWallet explains this and other fast moves in real ways to improve your credit.

Keep old accounts open: Length of credit history matters. Closing your oldest card can shorten your average age and dent your score.

Time your applications: Group auto loan inquiries within a short window so they count as one for scoring. This protects your tier while you shop offers.

Clear small collection accounts if they are recent and valid: Settled or deleted items reduce lenders’ risk concerns. Get any agreement in writing before paying.

Add a small cash buffer for a lower loan-to-value: A bit more down payment can offset a thin file and help you qualify at a better rate.

Stabilize your file details: Make sure name, address, and employer match across documents. Clean data reduces friction in underwriting.

Use a secured card or credit-builder loan if your file is thin: A few months of on-time payments can help you meet a minimum credit score car loan target near 600.

These steps serve as key stops on your Route 66-inspired path to credit improvement, with markers like Barstow and Yermo representing those pivotal moments of progress—perhaps even a detour to the nearby Calico Ghost Town for a reminder of how past missteps can be left behind. Aim to break key thresholds that affect pricing tiers by driving steady, consistent changes. Moving from the high 500s to the low 600s can open more options for bad credit dealer financing, and from there, push toward 660 to access stronger rates and better term choices—unlocking even sweeter deals in markets like Las Vegas.

Conclusion

The bottom line on what credit score for dealer financing is simple, especially in Las Vegas where regional travel goals like exploring nearby national parks await. Aim for 600 or higher as a working minimum, then push past 661 for stronger terms. Scores in the 700s unlock the best rates and more lender choice, opening doors to adventures at places like Valley of Fire State Park or beyond. Your file still matters, including income, debt, down payment, and the car you pick—key to from Las Vegas road trips that make the most of your investment.

Take clear steps before you shop. Check both your FICO and VantageScore, then get a credit union preapproval to benchmark offers. Pay down card balances, gather proof of income, and keep applications inside one shopping window. If your score is under 600, build a larger down payment, pick a modest late‑model car, and consider a qualified co‑signer to cut your rate. These moves support approvals for bad credit dealer financing while keeping costs in check, so you can hit the road to a national park without breaking the bank.

Ready to act? Use free credit tools to track your score, set a payment target that fits your income, and compare written offers at a trusted dealer. If rates still feel high, plan to refinance after 12 to 24 months of on‑time payments. A smart plan beats a quick yes every time, turning a minimum credit score car loan into a deal you can live with—perfect for driving to Bryce Canyon, Joshua Tree, or a quick escape to Valley of Fire. Grab a Las Vegas Drive Guide to start mapping those trips once your financing is secured.